What is a BIC Code?

Due to the technological advancements in which information transfers without delay, it is imperative for banking organizations to continue to be successful on their individual activities as well as activities of others they conduct business with. Every time a certain amount of money is transferred between a couple of banking organizations (similar with an international funds transfer) by means of a bank wire transfer, it is then assigned to a BIC Code or International Organization for Standardization (ISO 9362) that transmits significant information with regard to the transaction. The BIC Code enables banks to search for information at once with reference to both non-financial and financial institutions and is frequently regarded as the same with Bank identification Code (Bank BIC Code). The BIC Code will emerge as an 8 to 11 character code that recognizes such details as the bank or origin and country.

A BIC Code is assigned by Society of Worldwide Interbank Financial Telecommunication, an essential organization which allocates these codes in order to trace wire transfers. The Society of Worldwide Interbank Financial Telecommunication is known by all banks all over the world. As said previously, a BIC Code is just the same with a BIC code since the latter has similar information as the former. A BIC Code is imperative for companies who want to negotiate with customers in overseas countries since they make sure that there will be a trouble-free and secure transaction experience for both involved parties.

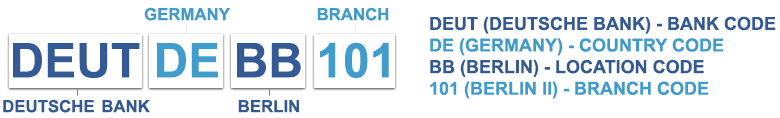

The coding metrics utilized in the BIC Code’s generation are quite simplistic and turn out to be increasingly intuitive as you take notice of them. Such codes are either 8 (when assigned from the main office) or 11 characters long and include both letters and digits. The initial 4 characters are assigned for its own bank code where the transfer came from and always contain letters. The succeeding characters, again only contain letters, represent the ISO-allocated country code. The 7th and 8th characters signify the code’s location and contain letters and numbers. Lastly, the final three characters are optional which are reserved for individual codes of the branch of the bank – when transferred from the main office, the last three characters will be signified with three X’s, or entirely left out.

Both businesses and banks are well served by learning further with regard to the standards of Bank Identification Code and by familiarizing them into the policies of the transaction for different reasons. Transferring a certain amount of cash globally can be difficult for both customers and businesses – being equipped to firmly wire money indicates that the experience of customers will be an encouraging one and will instigate constant patronage at some point.

In addition, being aware of how a BIC Code operates and what this code mean will avoid fraud as well – it is beneficial for a business to guarantee the transaction’s veracity. A BIC Code characterizes the standards to which every wire transfer, both domestic and international, is held to. In terms of transferring money, businesses and banking organizations like to understand where the currencies – yen, euro or dollar – came from and where it’s going. With the help of a Bank Identification Code, these banking institutions can guarantee that the money is completely secured.